Earnings per share (EPS) is more or less what it sounds like — a measurement of a publicly traded company’s profits on a per-share basis. We believe everyone should be able to make financial decisions with confidence. Trailing EPS uses historical earnings, typically from the previous four quarters in its calculation. Current EPS typically uses earnings from the four quarters of the current fiscal year, some of which may have passed, and some of which is in the future. Forward EPS typically uses projections of earnings, often for the coming four quarters.

Would you prefer to work with a financial professional remotely or in-person?

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. One of the first performance measures to check when analyzing a company’s financial health is its ability to turn a profit. Earnings per share (EPS) is the industry standard that investors rely on to see how well a company has done. One of the ways to make an informed investment decision is to compare the EPS figures for one company over a long time period.

Cumulative Preferred Shares

Shareholders of participating preferred shares receive dividends that match the specified rate of regular preferred dividends and an additional sum based on a pre-existing condition. Preferred shares are classified into cumulative what is target profit and how is it calculated preferred, non-cumulative, participating preferred, and convertible preferred stocks. Preferred shares, as the name implies, give preference to preferred shareholders and pay them dividends before common ones.

Why Is Earnings per Share (EPS) Important to Investors? FAQs

For individuals who are unfamiliar with the term “professional business register,” it is critical to define such terms as “earnings” and “shares.” Earnings per share is an extremely vital business statistic used to entice, persuade, and demonstrate to investors the advantages of putting their money into a particular firm. Broader economic factors and industry trends can affect a company’s net income and hence its EPS. Economic downturns, shifts in consumer behavior, or changes in regulation can impact EPS. Conversely, when a company repurchases its own shares, this can increase EPS by concentrating earnings among fewer shares. However, it’s important for investors to consider other financial indicators alongside EPS for a more comprehensive understanding of a company’s financial health.

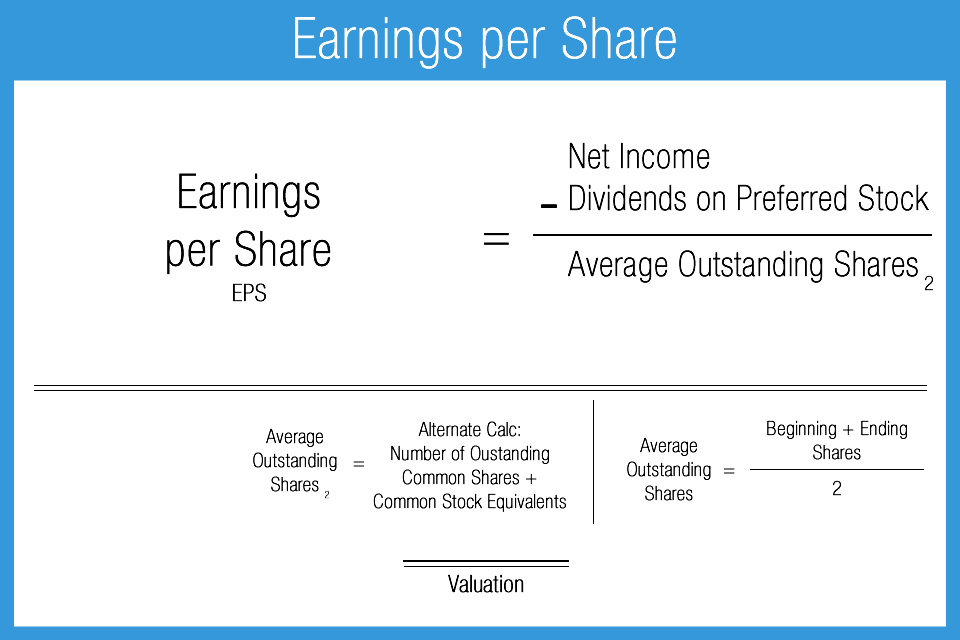

Basic EPS consists of the company’s net income divided by its outstanding shares. It is the figure most commonly reported in the financial media and is also the simplest definition of EPS. The formula in the table above calculates the basic EPS of each of these select companies. Basic EPS does not factor in the dilutive effect of shares that could be issued by the company. Earnings per share is one of the most important metrics employed when determining a firm’s profitability on an absolute basis.

Table of Contents

Net profit attributable to ordinary (common) shares is arrived at by deducting corporation tax and preference dividend from the amount of net profit earned in any particular year. For instance, if the company’s net income was increased based on a one-time sale of a building, the analyst might deduct the proceeds from that sale, thereby reducing net income. The share price of a stock may look cheap, fairly valued or expensive, depending on whether you look at historical earnings or estimated future earnings. Shareholders might be misled if the windfall is included in the numerator of the EPS equation, so it is excluded.

The diluted share count differs from the basic share count in that it adds shares that aren’t yet issued — but could be. For instance, executives may have stock options that are “in the money”; in other words, it would be profitable to exercise those options and turn them into shares. But basic share count does not account for those options, or for warrants (which function much like options). Basic EPS includes all of the company’s outstanding shares, while diluted EPS includes shares, stock options, warrants, and restricted stock units. Basic earnings per share are recorded in a company’s income statement and are quite important for assessing the performance of firms with just common shares.

- But this compensation does not influence the information we publish, or the reviews that you see on this site.

- They have similar limitations, but both have historically been reliable metrics for comparing companies and stocks.

- Because of their right to vote for corporate policies and elect board members, common shares are also known as ordinary shares or voting shares.

- Historically, they’ve been reliable methods of comparing companies, determining value, and finding buy or sell opportunities.

- This measurement figures into the earnings portion of the price-earnings (P/E) valuation ratio.

This is because, like debt, they are an obligation required to be paid before the common stockholders receive dividends. To get a more accurate projection of earnings on a per share basis, both Net Income and Common Stock are often adjusted by investors. You’ll find this figure at the bottom of a company’s income statement.

If you’re comparing one company with another, you’ll want to use diluted EPS if both companies report it. In some cases, companies may also provide an adjusted EPS number, which is usually diluted EPS with atypical one-time items removed. These reports typically take the form of press releases, PDFs or posts on a company’s website.

If a shareholder is not paid on time, preferred shares allow for that person to still receive their full dividend payment, including any missed or previous payments. It allows investors to measure and compare the profitability of different companies, enabling them to make more informed decisions when diversifying their portfolios. Factors such as net income, number of outstanding shares, dividends, potential share dilution, capital expenditure, and industry trends can significantly influence EPS. The Price/Earnings (P/E) ratio, for example, compares a company’s market value per share with its EPS, providing a broader perspective on the company’s value.

Preferred shares, on the other hand, provide preferred shareholders with no voting rights. This means that as a shareholder, you are entitled to part of the company’s profits through dividends and increased value if the company’s overall worth rises. This net profit is sometimes referred to as the bottom line or simply profit. It is one of the most important pieces of financial information about a company because it signals whether that business is making money or running at a loss.